by Roger | Jul 15, 2021 | Roger’s Rundown

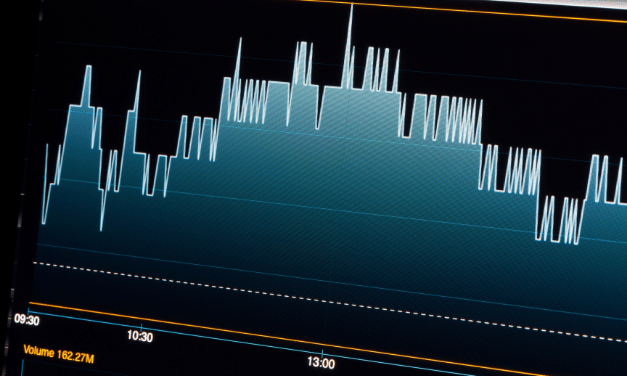

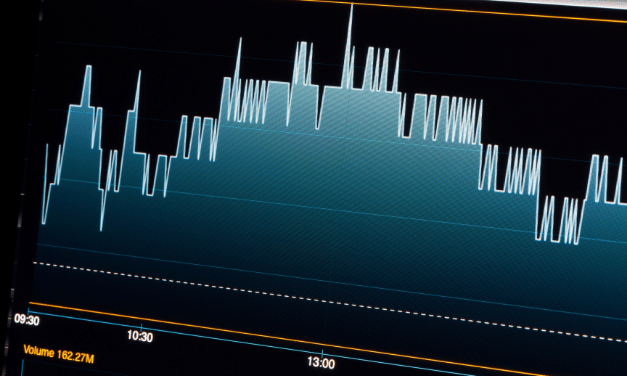

Inflationary pressure is at a 13-year high. Wall Street got hit by a lot of Federal Reserve data today, including manufacturing reports, industrial production, import and export prices and jobless claims. So this will help the market analyze our economy and determine...

by Roger | Jul 14, 2021 | Roger’s Rundown

Wall Street is weighing positive earnings reports with hot inflation data coming out this week. Large-cap stocks are still at overbought levels and may reverse toward their 50-day moving averages. Interest rate fears could ultimately push tech stocks and other large...

by Roger | Jul 12, 2021 | Roger’s Rundown

Small- and medium-cap stocks have been trading sideways for months now. Large-cap stocks continue to be overbought and have been pushing the S&P 500 and Nasdaq to record levels for weeks. With earnings season upon us and fresh economic data hitting the newswire...

by Roger | Jul 8, 2021 | Roger’s Rundown

The market is finally pulling back after the Federal Open Market Committee (FOMC) released its June meeting minutes. The Fed talked about easing its bond purchasing program starting in August/September. I’ve been talking about the vulnerability in the market for...

by Roger | Jul 7, 2021 | Roger’s Rundown

Tech stocks rallied as the bond market moved higher. This rally, however, will probably be short-lived due to stimulus adjustments. Momentum levels in the Nasdaq are unsustainable. That’s why I’ve identified three small-cap stocks that aren’t as sensitive to the...

by Roger | Jul 1, 2021 | Roger’s Rundown

I’ve never seen momentum levels narrow so much while indexes make new highs. But that doesn’t mean we can’t find some upside in this market. The Russell 2000 has been trading mostly sideways for the past six months. The top small-cap stocks provide much more upside...