Wall Street shrugged off a choppy open following weaker-than-expected economic news to close higher as bargain hunters stepped in to by the dip — and more in Friday’s stock market update. Ongoing concerns over U.S. elections and disappointment that congress has not delivered more stimulus were overlooked in what turned into a banner day to close the week.

The gains weren’t enough for the Dow and S&P 500 to avoid a fourth-straight weekly decline, however, and the longest weekly losing streaks since August 2019. However, the Nasdaq closed higher for the week after falling the previous three weeks.

Stock Market Update

The Nasdaq zoomed 2.3% after trading to an intraday peak of 10,939.

The S&P 500 soared 1.6% following the late day run to 3,306.

The Russell 2000 rallied 1.6% after testing a final hour high of 1,478.

The Dow jumped 1.3% with the afternoon high tapping 27,239.

For the week, the Russell tumbled 3.4%; Dow declined a 1.8%; and the S&P 500 lost 0.6%. The Nasdaq Composite gained 2.3%.

Technology was the strongest sector after surging 2.4% while Utilities and Healthcare rose 1.6%. Energy was the only sector laggard with a 0.1% pullback.

Stock Market Movers

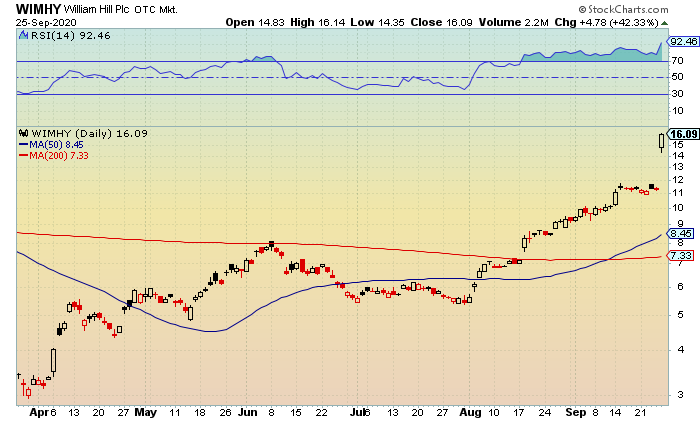

Shares of William Hill Plc (OTC: WIMHY) zoomed 42% after the company confirmed that it has received separate cash proposals from Apollo Global Management LLC (NYSE: APO) and Caesars Entertainment Inc. (Nasdaq: CZR) to discuss a potential takeover.

Talks are at an early stage, and there’s no certainty they will lead to a transaction. Apollo and Caesars have been given an October 23rd deadline to either announce a firm intention to make an offer for William Hill or announce that they do not intend to make an offer.

Stock Market Outlook

Cruise Line stocks will likely be in focus next week as investors await a possible update from the Centers for Disease Control and Prevention to address the September 30th no-sail date. While chances are high that the CDC extends the date again into the fourth quarter, the comments from will likely be positive and could signal a near-term return to cruise, which could be a catalyst for Carnival Corp. (NYSE: CCL), Norwegian Cruise Line Holdings Ltd. (NYSE: NCLH) and Royal Caribbean Cruises (NYSE: RCL).

Global Economy

European markets closed mostly lower to wrap up the worst week for trading since June.

Germany’s DAX 30 sank 1.1% and France’s CAC 40 was lower by 0.7%. The Belgium20 was off 0.3% and the Stoxx 600 slipped 0.1%. UK’s FTSE 100 added 0.3%.

Asian markets settled mixed to end the week.

Hong Kong’s Hang Seng declined 0.3% and China’s Shanghai dipped 0.1%. Australia’s S&P/ASX 200 soared 1.5% and Japan’s Nikkei added 0.5%. South Korea’s Kospi was up 0.3%.

U.S. Economy

Durable Goods Orders rose 0.4% in August after climbing 11.7% in July. Forecasts were for a rise of 1.5%. Transportation orders were up 0.5% after the 35.2% prior pop. Excluding transportation, orders also rose 0.4%, but July’s gain was revised sharply higher to 3.2%. Defense orders dropped -3.3% from the prior 30.8% gain. Nondefense capital goods orders excluding aircraft climbed 1.8% from and upwardly revised 2.5%. Shipments slid -0.3% versus the 7.6% July gain. Nondefense capital goods shipments excluding aircraft rose 1.5% versus 2.8%. Inventories slid -0.1% after dropping -0.8% previously. The inventory-shipment ratio was stead at 1.72.

Baker-Hughes reported the U.S rig count was up 6 from last week to 261 with oil rigs higher 4 to 183, gas rigs up 2 to 75, and miscellaneous rigs unchanged at 3. The U.S. Rig Count is down 599 rigs from last year’s count of 860, with oil rigs down 530, gas rigs down 71, and miscellaneous rigs up 2. The U.S. Offshore Rig Count was unchanged at 14, down 10 year-over-year.

Stock Market Sentiment

The iShares 20+ Year Treasury Bond ETF (Nasdaq: TLT) was flat after testing an intraday high of $165.42. Near-term and lower resistance at $165.50-$166 was challenged but held. A close above the latter and the 50-day moving average would suggest additional strength towards $167-$167.50.

Current support remains at $164.50-$164 followed by $163-$162.50.

Volatility Index

The iPath S&P Vix Short-Term Futures (NYSEArca: VIX) settled lower for the second-straight session after trading to a late day low of 26.02. Near-term and upper support at 26.50-26 was recovered. A close below the latter would indicate another retest towards 25.50-25 and the 50-day moving average.

Resistance remains at 29-29.50 and the 200-day moving average followed by 31-31.50.

Stock Market Analysis

The Wilshire 5000 Composite Index (NYSE: WLSH) showed strength for the second-straight session after tagging an intraday high of 33,893. Current and lower resistance at 33,750-34,000 was cleared and held. A move above the latter would indicate further upside towards 34,250-34,500 and the 50-day moving average.

Rising support is at 33,500-33,250 followed by 33,000-32,750.

Sector

The Industrials Select Sector SPDR Fund (NYSE: XLI) was up for the second-straight session after testing an intraday high of $76.75. Current and lower resistance at $76.50-$77 was reclaimed. A close above the latter would be a ongoing bullish signal with retest potential towards $78-$78.50.

Fresh support is at $76-$75.50 and the 50-day moving average followed by $74.50-$74.

RSI is back in a slight uptrend after clearing and holding lower resistance at 45-50. A close above the latter would suggest ongoing strength towards 55-60 with the latter representing the monthly high. Support is at 40 and a level that has been holding since early April.

Check back for the most important news and numbers each day after the closing bell here in the WealthPress stock market update.