The stock market closed mostly lower as Wall Street reacted to news that President Donald Trump and first lady Melania tested positive for the coronavirus — and more in Friday’s stock market update. A weaker-than-expected jobs report for September also weighed on sentiment and overshadowed ongoing negotiations in Congress for another round of stimulus aid.

Despite the overall weakness, the Dow and the S&P 500 snapped 4-week losing streaks. The Nasdaq extended its winning streak to two-straight weeks while the Russell 2000 closed higher for the second time in three weeks.

Stock Market Update

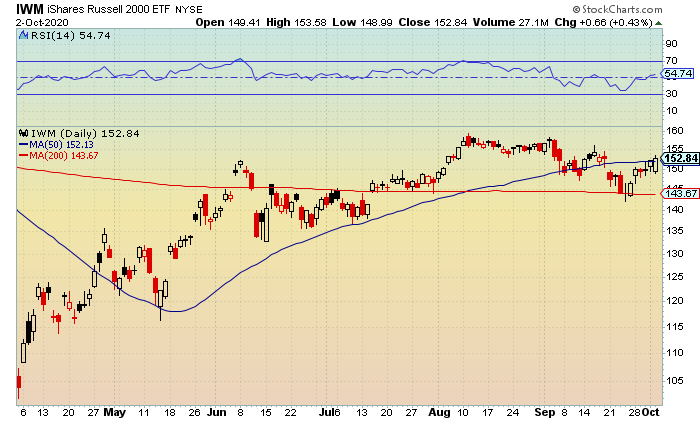

The Russell 2000 gained 0.5% despite trading to an opening low of 1,498.

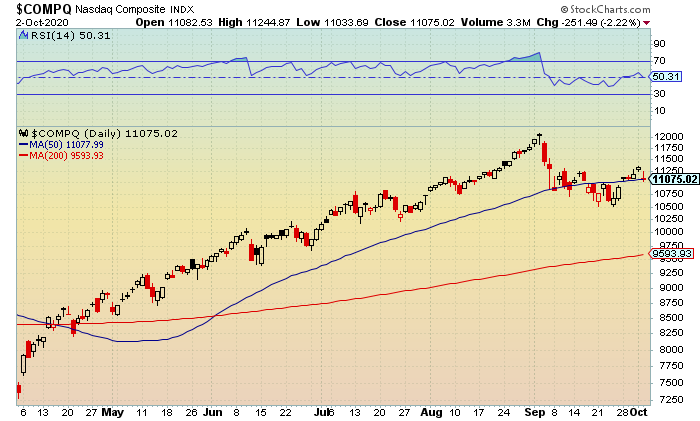

The Nasdaq tumbled 2.2% following the midday fade to 11,033.

The S&P 500 was lower by 1% with the intraday low tapping 3,323.

The Dow was down 0.5% after testing a morning low of 27,382.

For the week, the Russell 2000 zoomed 4.4% and the Dow surged 1.8%. The Nasdaq and the S&P 500 jumped 1.5%.

Real Estate and Utilities led sector strength after gaining 1.6% and 1.2%. Technology and Communications Services paced sector laggards with losses of 2.6% and 2%, respectively.

Stock Market Movers

Tesla Inc. (Nasdaq: TSLA) fell 7% after the company announced it produced just over 145,000 vehicles and delivered nearly 140,000 vehicles for the third quarter.

Shares of Mesoblast Ltd. (Nasdaq: MESO) sank 35% after the company announced the FDA issued a complete response letter for the drug Ryoncil as a therapy for pediatric steroid-refractory acute graft. The company will likely have to get more trials completed as the news was an unexpected outcome since the FDA had previously voted 9-1 in favor of approving Ryoncil back in August.

Stock Market Outlook

The stock market will likely shift its focus over the near-term from the economy to President’s Trumps’s covid-19 recovery and how it could affect the election outcome or public health policy. The future presidential debates may not happen but these were not seen as especially significant, especially after the first was a flop.

Some political pundits believe if President Trump recovers from covid-19 that its could be a game changer for the election. If he recovers quickly, it could be a big boost for his campaign. If he becomes very ill, even with the sympathy vote, it will show his approach to the pandemic was mishandled. In any event, his health will be a big concern over the next couple of weeks.

Global Economy

European markets closed mostly higher for the second-straight session.

The Belgium20 and UK’s FTSE 100 rose 0.4% while the Stoxx 600 climbed 0.3%. France’s CAC 40 was up less than a point, or 0.02%. Germany’s DAX 30 was down 0.3%.

Asian markets closed lower in limited action as South Korea’s Kospi, Hong Kong’s Hang Seng and China’s Shanghai were closed for a holiday.

Australia’s S&P/ASX 200 sank 1.4% and Japan’s Nikkei fell 0.7%.

U.S. Economy

Nonfarm payroll increased 661,000 in September versus expectations for a print of 850,000. The unemployment rate declined to 7.9% from 8.4%. The labor force dropped -695,000 while household employment was up 275,000.

Factory Orders rose 0.7% in August, missing forecasts of 1%, after climbing 6.5% in July. The 0.4% increase in Advance durable orders was revised to 0.5%. Transportation orders increased 0.5% after the 35.3% surge in July. Excluding transportation, orders were up 0.7% following July’s 2.4% gain.

Consumer Sentiment was upwardly revised to to 80.4 in the final September print versus forecasts for a reading of 79. The expectations index led the bounce, rising to 75.6 from August’s 68.5. The current conditions index came in at 87.8 versus 82.9 in August. The 12-month inflation gauge cooled to 2.6% versus 3.1% in August. The 5-year measure was steady at 2.7%.

Baker-Hughes Rig Count reported the U.S. rig count was up 5 rigs from last week to 266 with oil rigs up 6 to 189, gas rigs down 1 to 74, and miscellaneous rigs unchanged at 3.

Stock Market Sentiment

The iShares 20+ Year Treasury Bond ETF (Nasdaq: TLT) flipped-flopped for the fifth-straight session after testing an intraday low of $162.18. Current and upper support from at $162.50-$162 was breached but held for the second-straight session. A close below the latter would indicate a retest towards $161-$160.50 with the late August low at $160.64.

Resistance remains at $163.50-$164 with more important hurdles at $165-$165.50 and the 50-day moving average.

Volatility Index

The iPath S&P Vix Short-Term Futures (NYSEArca: VIX) extended its winning streak to four-straight sessions after hitting an intraday high of 29.90. Prior resistance from last week at 29-29.50 and the 200-day moving average was breached but levels that held.

New support is at 27-26.50 followed by 25.50-25 and the 50-day moving average.

Stock Market Analysis

The SPDR S&P 500 ETF (NYSEArca: SPY) fell for the just the second time in seven sessions after bottoming out at $331.19. Current and upper support at $331.50-$331 was tripped but held. A close below the latter would indicate additional weakness towards the $330.50-$330 area.

Lowered resistance is at $336-$336.50 followed by $338.50-$339.

RSI is rolling over with key support at 50 holding. A close below this level would signal weakness towards 45-40. Resistance is at 55-60.

Sector

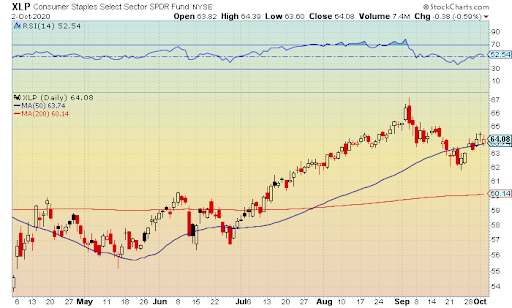

The Consumer Staples Select SPDR Fund (NYSE: XLP) had its two-session winning streak snapped on the pullback to $63.60. Near-term and upper support at $64-$63.50 was breached but held. A close below the latter and the 50-day moving average would indicate a retest towards $62.50-$62.

Resistance is at $64.50-$65. A close below the latter would be an renewed bullish signal for a possible run towards $67-$67.50 with the early September all-time high at $67.61.

RSI reversed course with upper support at 55-50 failing to hold. There is weakness towards 45-40 on a close below the 50 level. Resistance is at 55-60.

Check back for the day’s most important numbers in the WealthPress stock market update.