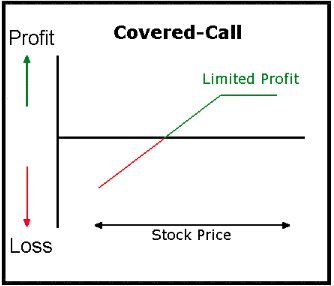

Many traders believe that receiving premium for the covered call is the most important part in the process. But there are many things that can happen between the time the covered call position is opened and closed, and that’s what I want to discuss with you today.

There are three possible scenarios that can occur when you initiate a covered call spread: The stock can move higher, the underlying stock can move lower or the underlying stock can stay at relatively the same price as when the trade was first initiated. I will cover each of these three possible scenarios one by one.

Let’s assume that you bought ABC stock at $92, and it’s currently trading a $92.00 per share. Earlier today we sold a $95 strike price call option that expires 7 weeks from now. When you sold the call option you took in $4.50 of premium or a total of $450.00 since each contract equals 100 shares.

ABC stock trades higher

If ABC stock moves up to $100.00 before expiration, you will end up selling the stock to the buyer of the call option. The buyer will exercise his option, and you will end up selling 100 shares of ABC stock at $95.00 per share to the buyer of the call option.

In this case, you made money on the call option, since you kept the $4.50, which was the premium that you received on the deal. In addition, since the buyer bought the 95 strike price call option, he is required to buy the stock from you at $95.00 per share, even though the current market price is $100.00 per share.

Nonetheless, since you bought ABC stock at $92.00 per share and you sold it at $95.00 per share, you still made $3.00 per share profit, in addition to the $4.50 per share that you received from selling the option, so you made a total of $7.50 on the transaction.

ABC stock remains at or near the strike price

In this scenario, ABC stock will move from $92 dollars to $95.00 but won’t move higher prior to expiration.

This creates the best case scenario for the call seller. If the underlying stock is at or below the strike price at expiration, the call seller gets to keep the premium and the shares. While the call buyer loses his $4.50 that he paid for the 95 strike price call option. The only time the buyer would exercise the call option is when the stock closed above the strike price before expiration. In our scenario, the stock never traded above $95.00 per share, so there would be no incentive for the call buyer to exercise the option.

The call seller can liquidate the stock after his obligation expires and collect the difference between paid and the current market price for the stock, which in our case would be $3.00, since the stock was purchased at $92.00 and sold at $95.00.

Or alternatively, the call seller can once again sell calls against the same position since he never had to sell the stock and his obligation already expired.

ABC stock trades below purchase price

In this case scenario, ABC stock begins moving lower after the call seller created his obligation, and settles at $88.00 per share at the time the call option expires.

The worst case scenario for the call seller occurs when the underlying asset moves lower after the call option is sold.

In this situation, the calls would expire worthless, since the stock went lower instead of moving higher and when the call option expired, the stock was well below the 95 strike price. The call seller would once again get to keep the premium which would be used to offset the loss that was incurred by the stock moving from $92.00 per share to $88.00 per share.

The call seller lost $4.00 in the value of the underlying asset, but gained $4.50 from the sale of the premium to offset the loss completely.

However, the situation could have been much different and the stock could have lost substantially more value between the time the option was sold till the option expired; which is the amount of time the option seller is locked into the trade, unless he chooses to end his obligation by buying back the option at market price.

Buying back a call option to unwind your obligation is not a bad idea, since call options decrease in value when stocks move down, giving you an opportunity to buy back the call option at a lower price than what you originally sold it for.

My best advice, is to figure out your break even point and liquidate the position if the underlying asset reaches that level. I typically calculate my break-even on the trade and liquidate the stock and my obligation as a seller of the option when the stock gets dangerously close to my break-even on the trade.

To calculate your break-even, simply subtract from your entry price the amount received from selling premium. In our particular case, we bought the stock at $92.00 and brought in $4.50 in premium, so our break even on the trade is $92.00 – $4.50 = $87.50

If ABC stock began breaking down and traded close to the $88.00 level, I would strongly consider liquidating the stock and buying back the option at that time.

Roger Scott

Senior Publisher

WealthPress