The major indexes were flat Tuesday morning as the market looked to shrug off the impact of higher oil prices.

As I mentioned in Monday’s stock market outlook video, OPEC+ cut oil production by 1.16 million barrels per day, causing prices to spike.

The market has been resilient, even in the face of stubborn inflation, higher interest rates and the recent crisis in the Financials sector.

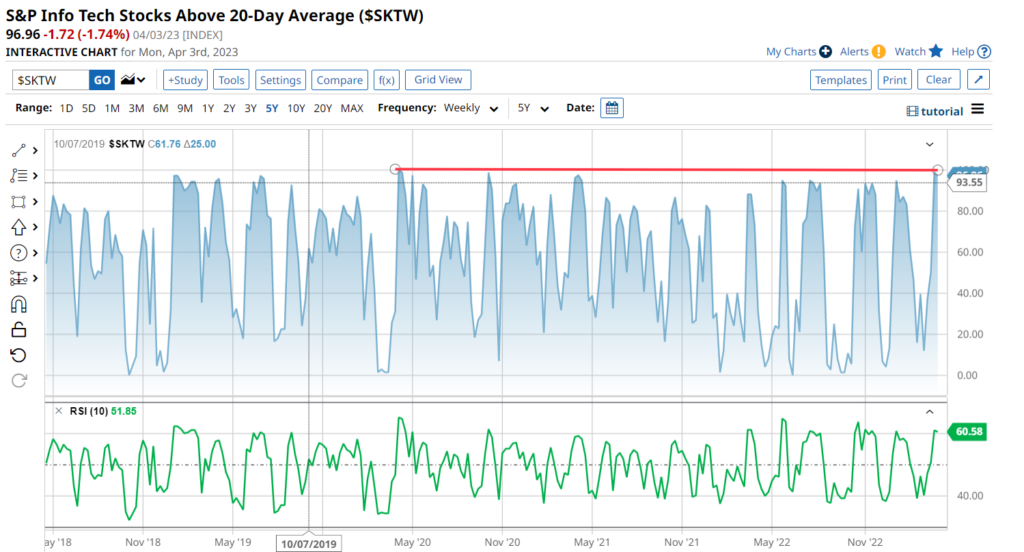

But what I’m really focused on are momentum levels…

We’re making history right now… short-term momentum levels have not been this high on tech since the COVID-19 recovery bounce.

In this morning’s stock market recap video, I’ll discuss why I’m nervous about the tech sector… which sector I believe will move higher… what will happen with bonds in the next few sessions… how the market will react to the OPEC+ fiasco… plus the top two stocks I’m buying and the ones I’m selling!

Don’t forget to like, subscribe and leave your comments and questions on our YouTube videos — we will respond!

P.S. NEW Scanner and a Debut Trading Session

Lance Ippolito has been working on something behind the scenes for a while now, and it’s finally ready for the grand reveal…

It’s a brand-new options scanner. And what makes it different from anything he’s developed before is its ability to show only the opportunities he’s willing to consider trading!

In other words, it filters out everything that’s not worth the time or money…

And now, Lance is watching it spit out opportunities on Snow, AI, Alibaba and Tesla… just to name a few!

Lance is about to reveal how the scanner works in a special live trading session at 1 p.m. ET today, April 4!

Sign Up for His Presentation Here

P.P.S. When it comes to trading, every second counts. And in choppy markets like these, often driven by headlines, stocks can make big moves in a flash.

That’s why I want you to get my latest trading ideas and market updates as fast as possible. So I’m rolling out an all-new option for my students to receive trade alerts with Telegram!

Telegram allows me to get trade ideas, videos and watchlists to you in a matter of seconds.

Check out this short article we put together with instructions on how to download telegram and access my private channel. Go here to get the details.

On Tuesdays, I’ll detail the strongest and weakest sectors in the entire market. I’ll tell you exactly where I’d put my money and go long, and which ones I’d avoid or even short. Using my proprietary momentum indicator, you’ll get actionable ideas on every market sector, every single Tuesday.

Need help understanding some basics that we discuss frequently? Check out some of our educational pieces to help get yourself up to speed! Have a question or a topic you’d like us to explain in a future article? Send your thoughts to [email protected]!

- What Is the Dow and How Does It Work?

- A Beginner’s Guide to the Nasdaq and How to Trade It

- What Companies Make up the S&P 500 and How Can I Trade It?

- What Is the VIX? Understanding Stock Market Volatility

- A Beginner’s Guide to Stock Sector Analysis and Relative Strength

- How to Pick Winning Stocks With Simple Market Analysis Tools

Check back each morning for the Roger Scott newsletter and the most important news and numbers in the WealthPress stock market recap.